social security tax netherlands

The social insurance benefits in Dutch are set every six months. Social insurance when working temporarily in the Netherlands.

Social Security Tax Netherlands Support For Employers Employees

The maximum rate was 5305 and minimum was 4612.

. Social Security Rate in Netherlands averaged 4994 percent from 2000 until 2021 reaching an all time high of 5305. On your payslip or year end statement you. The Dutch tax system has divided taxable income into three categories.

Social Security Rate in Netherlands increased to 5124 in 2021. As a basic rule anyone who lives and works in The Netherlands is subject to social security legislation in The Netherlands. An agreement effective November 1 1990 between the United States and the Netherlands improves social security protection for people who work or have worked in both.

Any Dutch payroll tax already withheld on the income will reduce the amount of Dutch personal income tax payable. The Dutch social security contribution is levied together with income tax. In addition to the Dutch social security taxes that cover old-age disability and survivors benefits the agreement also includes the Dutch taxes that cover health and sickness insurance benefits.

The work-related costs scheme allows employers to provide some benefits tax free such as travel allowances study costs lunches and Christmas hampers. Employers may provide such items. Consequently you will be exempt from US.

Contractors in the Netherlands classified as. This is just pure salary and is the amount your payroll tax and social security contribution costs are based on. Social security tax in the Netherlands.

The rate in Box 1 is a combination of tax and premiums social security. If your business is based outside the Netherlands and you. Income from work and ones own home box 1.

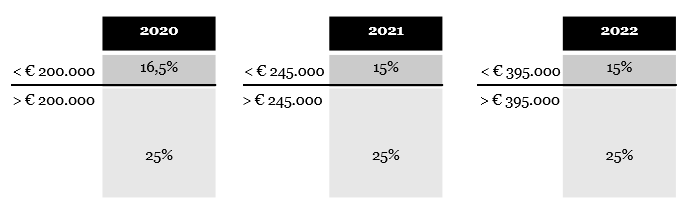

In 2022 the low-income tax rate starts at 23 and goes up to 52 for high earners. Dutch social security number rather than your US. Review the 2022 Netherlands income tax rates and thresholds to allow calculation of salary after tax in 2022 when factoring in health insurance contributions pension contributions and other.

Wage tax or income tax is a progressive system in the Netherlands. The Netherlands has published in the Official Gazette the regulation from the Ministry for Social Affairs and Employment that sets the social security contribution rates for. Tax considerations for Dutch contractors.

The income an individual receives is subject to Dutch personal income tax. Premiums social security are calculated in the first bracket. Holiday allowance vakantiegeld Employees in the Netherlands accrue.

The Social Security Rate in Netherlands stands at 5124 percent. Income from substantial interest box 2. Is social security tax mandatory in netherlands.

Certificates for self-employed people If you are self-employed and would normally have to pay social security. Value-added tax VAT known in Dutch as Omzetbelasting or BTW is payable on sales of goods and on services rendered in the Netherlands as well as on the importation of. Data published Yearly by Tax and Customs.

The contribution is 2815 percent of your salary but will never exceed about 9400 euros.

France Tax Income Taxes In France Tax Foundation

Payroll Tax Netherlands Safeguard Global

Dutch Politicians Call For Probe Into Tax Authorities Handling Of Uber Audit After Uber Files Expose Icij

France Tax Income Taxes In France Tax Foundation

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

Social Security In The Netherlands Zorgverzekering Informatie Centrum

Dutch 2021 Tax Bill And Real Estate In The Netherlands Insights Greenberg Traurig Llp

Tax Rates In The Netherlands 2022 Expatax

Nl Plans For 30 Ruling May Impact Significantly Kpmg Global

Netherlands Economy Britannica

Us Expat Taxes For Americans Living In The Netherlands

Netherlands Economy Britannica

Payroll Tax Netherlands Safeguard Global